Wellness economy set to hit £7.6 trillion by 2029, says GWI report

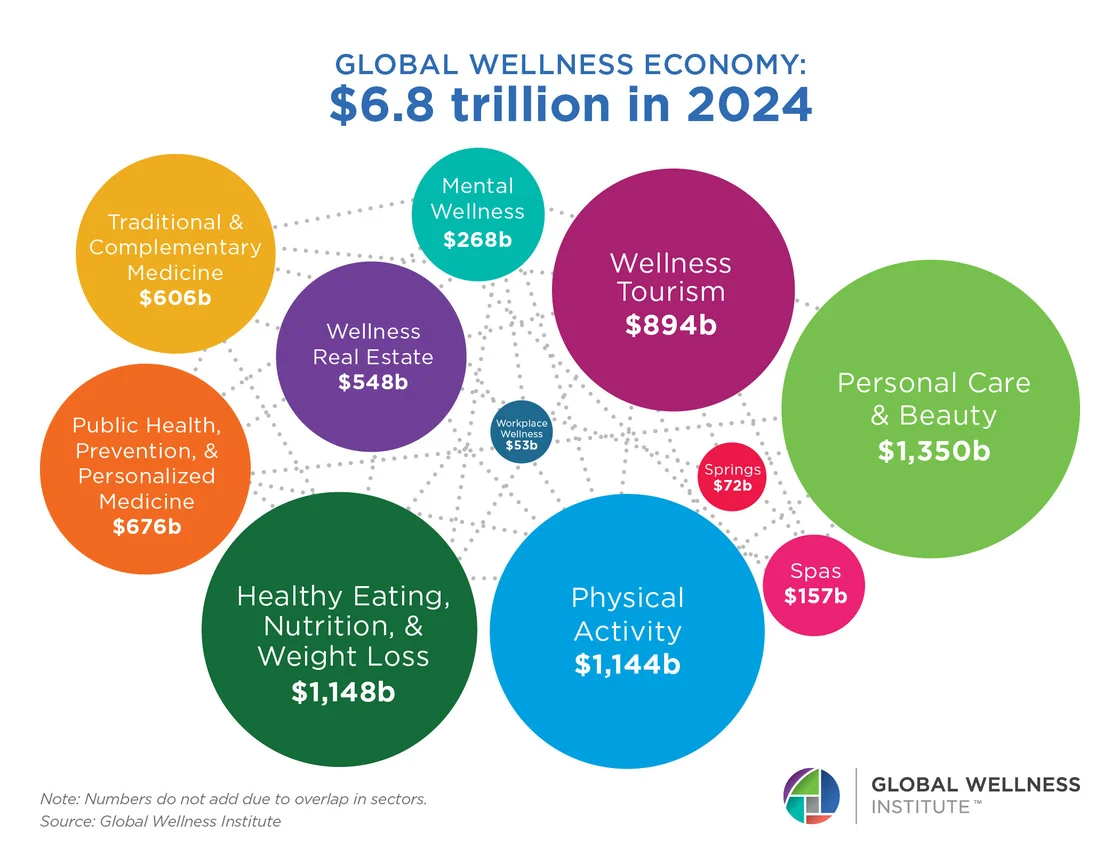

The global wellness market reached US$6.8 trillion (£5.17 trillion) in 2024 and is forecast to climb to $9.8 trillion (£7.45 trillion) by 2029, according to new research from the Global Wellness Institute (GWI).

The global wellness market reached US$6.8 trillion (£5.17 trillion) in 2024 and is forecast to climb to $9.8 trillion (£7.45 trillion) by 2029, according to new research from the Global Wellness Institute (GWI).

The Global Wellness Economy Monitor 2025 underlines accelerating growth across most wellness markets, with implications for UK spa and beauty professionals seeking to capitalise on rising consumer demand.

Europe shows strong growth and high per-capita spend

Europe recorded 6.3% average annual growth from 2019–2024, the report found, and per-capita wellness spending in the region stands at $1,876 (£1,426).

A companion GWI UK analysis shows the UK wellness economy reached $223.8 billion (£170.1 bn) in 2022, signalling a substantial domestic market for spas, clinics and beauty operators.

Real estate and mental wellness lead the gains

Among the 11 sectors tracked, wellness real estate and mental wellness were the fastest-growing from 2019–2024, at 19.5% and 12.4% average annual growth respectively.

Looking ahead to 2029, wellness real estate is forecast to grow 15.2% annually, while traditional and complementary medicine (10.8%), mental wellness (10.1%) and thermal/mineral springs (10.0%) are also projected as fast gainers – trends that are expected to drive demand for new spa developments, longevity services and destination-based experiences.

Recovery from pandemic has turned into acceleration

GWI notes the wellness economy has fully recovered from pandemic lows: all 11 sectors now exceed their 2019 values and the global market grew 7.9% from 2023 to 2024. The institute also calculates wellness now represents 6.12% of global GDP.

What this means for UK spa and beauty professionals

Spa operators can tap into rising real-estate-wellness development, as spa destinations and wellness communities become more popular.

Beauty businesses that offer mental wellness or holistic therapies are well placed to benefit from the strong projected growth in mental health–oriented wellness.

Destination spas and thermal retreat operators may see investment interest grow, aligning with future hot-springs growth.

UK-based professionals should also watch for increasing demand in longevity and preventative medicine, as traditional complementary medicine accelerates.

Expert insight

Katherine Johnston, senior research fellow at GWI, commented: “Now that the wellness economy has fully recovered from the pandemic, we can see how unstoppable it is as a consumer trend.

"There’s been a sea change in consumer mindsets, with prevention, mental health, social connection, the impacts of our living environments, and nature becoming dramatically more important.

"These shifts are fueling growth across all wellness sectors…to more sophisticated preventative medical-wellness solutions.”